Discussing funeral costs is never easy. It’s a topic many of us avoid because it’s tied to loss and discomfort. However, thinking about it now isn’t about dwelling on the inevitable; it’s about providing one of the most lasting gifts you can give your family: peace of mind.

Taking a few minutes to understand the actual costs today can prevent your loved ones from facing financial stress during an already heartbreaking time. This guide will walk you through the real costs, state by state, and show you a simple way to ensure everything is taken care of.

The Two Main Paths to Coverage for Seniors

- Simplified Issue Life Insurance: This is the most common path for seniors with well-managed conditions. You will answer a few health questions on an application, but you will not have to take a medical exam. Approval is often granted in minutes or days.

- Guaranteed Issue Life Insurance: This is the ultimate safety net. There are no health questions and no medical exam. As long as you meet the age requirements (typically 50–85), your approval is guaranteed. You cannot be turned down for health reasons.

How Insurers View Common Senior Health Conditions

- For High Blood Pressure: Insurers want to see that it’s well-managed with medication. If your readings are stable and you follow your doctor’s advice, you can often qualify for excellent rates on simplified plans.

- For Type 2 Diabetes: They will look at when you were diagnosed, your A1c levels, and your medications. Well-controlled diabetes is very commonly accepted for simplified issue policies.

- For a History of Cancer: The key factor is time. If you have been in remission and cancer-free for two or more years, you have a very strong chance of being approved for a simplified issue plan. If treatment was more recent, a guaranteed issue policy is a fantastic and certain option.

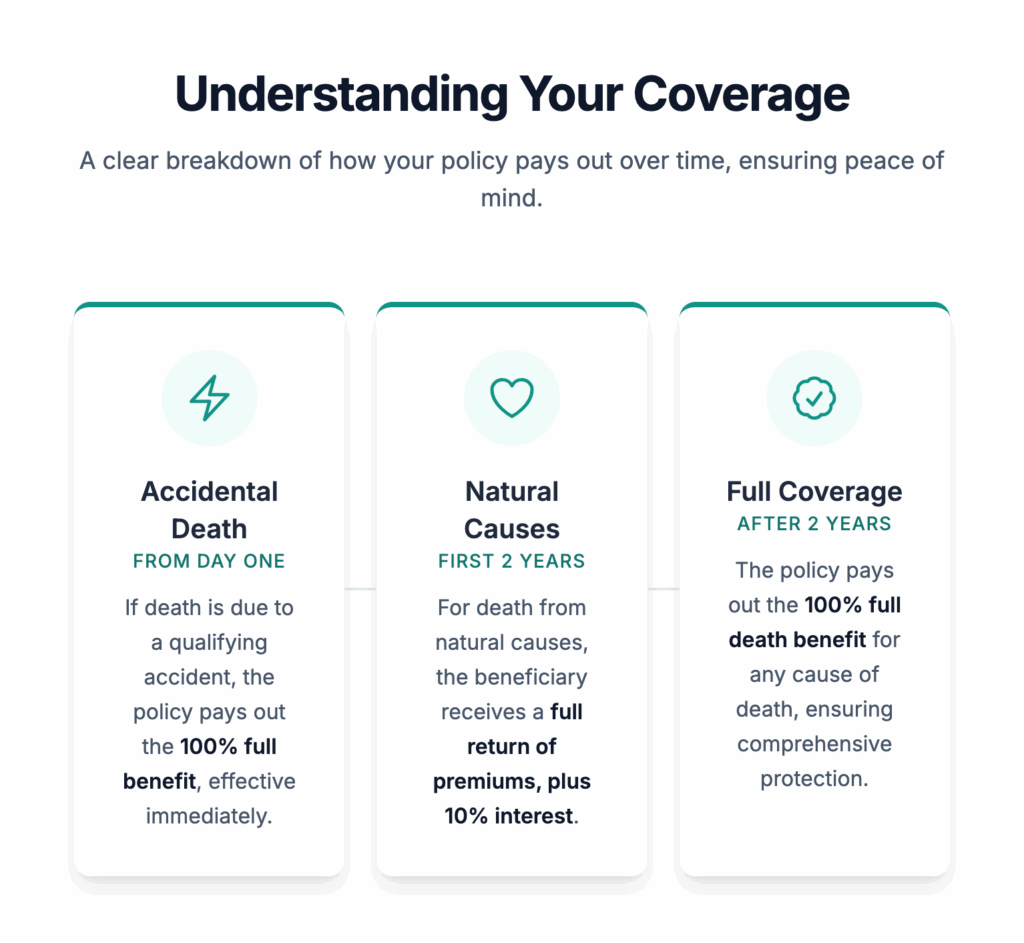

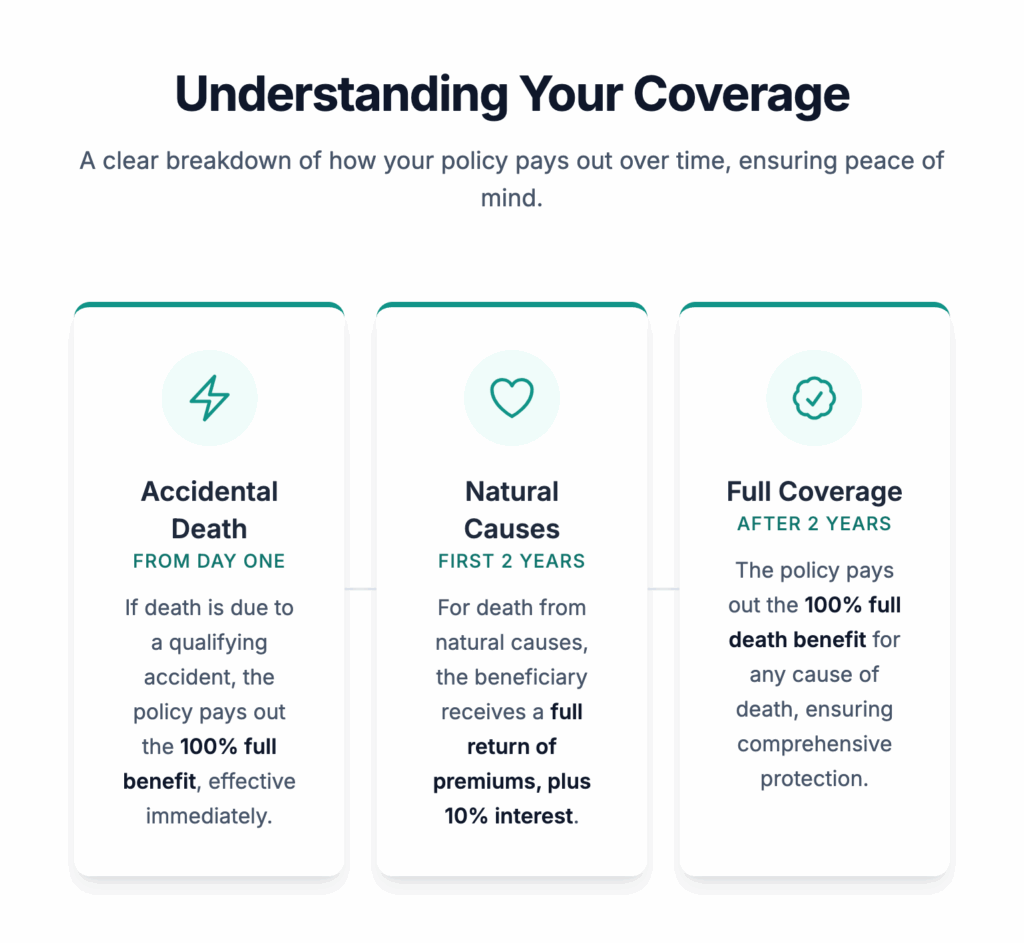

The Important Trade-Off: Understanding Graded Benefits

Seeing these numbers, you might think, “I’ll just set aside money in savings.” While saving is always wise, a dedicated final expense policy offers key advantages designed to protect your family from a

To make guaranteed approval possible, these policies have a feature called a “graded death benefit.” It’s a straightforward safety measure for the insurer that ensures everyone can get coverage.

stress. Here’s why it matters:

This structure allows companies to provide coverage to everyone, regardless of their health history, giving you a clear path to peace of mind.

Frequently Asked Questions (FAQ)

This is a common and dangerous misconception. The Social Security administration provides a special one-time death payment of $255, and only to a surviving spouse or child. As our funeral cost guide shows, this is not nearly enough to cover even a basic cremation.

No. As long as you pay your premiums, the company can never cancel your policy for any reason. Your coverage is permanent, and your rates are locked in for life, regardless of any future changes in your age or health.

Yes, it’s very important to be honest. Your application gives the insurer permission to review your prescription history. Transparency helps them place you in the best, most affordable plan you qualify for. Your rights to privacy are protected by federal law, which you can review on the U.S. Department of Health & Human Services (HHS.gov) website.

It depends on the condition and how it’s managed. For a well-managed issue, the cost may be very close to that of a healthy individual. For more significant conditions requiring a guaranteed issue policy, the premium will be higher.

Nothing at all. Once your policy is active, any future changes in your health cannot change your rates or your coverage. This is a major benefit of securing a plan sooner rather than later.

Don’t Let Health Worries Stop You

Your health history is part of your story, but it doesn’t have to be a barrier to protecting your family. At Sagewise, we help you compare options from different carriers to find a plan that fits your needs and budget, regardless of your health.

Find out what you qualify for. It takes 60 seconds to get a free, no-obligation quote and see your options.