It’s not a pleasant topic, but planning for your final expenses is a profound gift to your family. The cost of a funeral can place a large and immediate financial strain on loved ones.

For seniors—especially those in their 50s, 60s, 70s, and 80s—who may not have a large life insurance policy, a burial insurance plan can step in to cover this cost, protecting your family’s savings.

Burial insurance is a small life insurance policy designed to cover your funeral, burial, and other end-of-life expenses like final medical bills. Coverage is typically modest, starting at $1,000 and maxing out around $25,000. When you pass away, your beneficiary (such as your adult child) receives a lump-sum, tax-free check.

Also known as “final expense insurance,” these policies are designed for seniors and are easy to qualify for.

Key Takeaways

- It’s a Small, Permanent Policy: Burial insurance is a small whole life policy that never expires and has premiums that are locked in for life.

- It’s Easy to Qualify For: Most policies for seniors do not require a medical exam, and some have guaranteed approval.

- The Payout is Flexible Cash: The money goes to your beneficiary (not a funeral home) to use for any expenses, 100% tax-free.

- It’s Different From a “Pre-Paid Plan”: A cash policy is far more flexible and safer than a pre-paid funeral plan.

The 2 Ways to Qualify (No-Exam Options)

“Burial insurance” isn’t a formal product type; it’s a marketing term for a simple, senior-focused whole life policy. There are two easy ways to get one:

- Simplified Issue This policy is the best-value option. It does not require a medical exam, but you will have to answer 3-5 simple “yes/no” health questions on the application. (e.g., “Are you currently in a hospital?”).

Even with common, well-managed conditions, you can often get approved for this plan. It offers the lowest cost and immediate, 100% coverage from the first day.

- Guaranteed Issue (or Guaranteed Acceptance) This policy has zero health questions and no medical exam. If you are in the eligible age range (e.g., 50-85), your approval is guaranteed.

This is the perfect solution for seniors with significant health issues who have been turned down for other insurance. Because the insurer is taking on a risk without knowing your health, these policies cost more and almost always include a 2-year “graded benefit.”

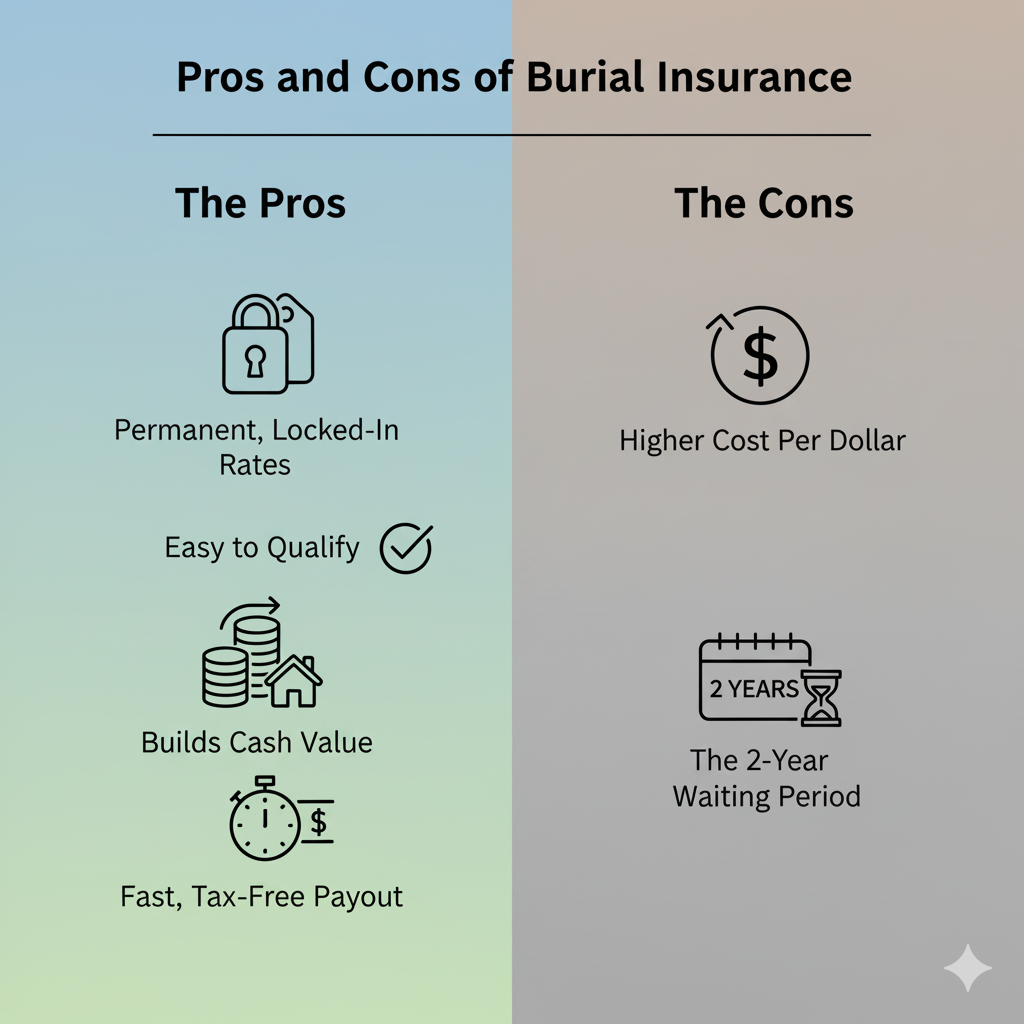

Pros and Cons of Burial Insurance

This type of plan offers incredible peace of mind, but it’s important to understand the full picture.

The Pros:

- Permanent, Locked-In Rates: It’s a whole life policy. It will never expire, and your monthly premium is guaranteed to never increase, which is perfect for a fixed income.

- Easy to Qualify: The “no-exam” options make it accessible for seniors, even those with pre-existing health conditions.

- Builds Cash Value: A small portion of your premium builds a “cash value” that you can borrow against in an emergency.

- Fast, Tax-Free Payout: The benefit is paid to your family in days, not months, and is 100% income-tax-free.

The Cons:

- Higher Cost Per Dollar: Because there’s no medical exam, the insurer is taking on more risk. This makes a $20,000 final expense policy more expensive than a $20,000 traditional policy you would have gotten at age 30.

- The 2-Year Waiting Period (on Guaranteed Issue): As mentioned, if you get a guaranteed acceptance plan, you have a 2-year waiting period for the full benefit to be active for natural causes. (Accidental death is covered 100% from day one).

How Much Does Burial Insurance Cost?

The price goes up with age, so the best time to get a plan is today. The rate you lock in at age 65 is significantly cheaper than the rate you will be offered at age 75.

Below are sample monthly rates for Guaranteed Issue policies. (Simplified Issue plans for healthier seniors would be even cheaper).

Average Monthly Premiums (Guaranteed Issue)

How Much Coverage Do I Actually Need?

This is the best part: you are no longer trying to replace 30 years of salary. Your new goal is to protect your savings. Instead of a generic example, use our simple tool to find your personal number.

Find Your "Peace of Mind" Number

The Critical Difference: Burial Insurance vs. Pre-Paid Funeral Plans

This is the most important and confusing decision many seniors face. They sound identical, but they are completely different.

One is a flexible, protected cash benefit for your family. The other is a restrictive, risky pre-payment to a single business.

A cash policy is almost always the safer, more flexible choice. Let’s do a side-by-side comparison.

Burial Insurance (A Cash Policy) – Our Recommendation

This is a whole life insurance policy. It is a secure, private contract between you and a highly-rated insurance company.

- The Payout: The benefit is paid directly to your beneficiary (your adult child or trusted loved one) as a lump-sum, tax-free check. Your family gets the money, not a funeral home.

- The Flexibility: 100%. This is the most important benefit. Your family gets the cash, usually within days. They can use it at any funeral home, in any state. If you move to be with your kids, the policy moves with you. If they find a more affordable cremation option, they can choose it.

- The Leftover Money: This is critical. If you have a $15,000 policy and the funeral costs $10,000, your family keeps the extra $5,000, tax-free. It’s a final gift to help them with other bills or just to provide a cushion.

- The Protection: The policy is protected from your creditors and bypasses the entire probate process (unlike a bank account). It is a safe, reliable financial tool.

Pre-Paid Funeral Plan (“Funeral Insurance”)

This is a pre-payment plan you set up directly with a specific funeral home. You are paying for a pre-selected package of services.

- The Payout: The benefit is paid directly to the funeral home. Your family never sees the money.

- The Flexibility: Zero. This is the critical risk. The money is locked in with that one business and its specific services. What if you move to another state to live with your children in 10 years? The plan is now worthless. What if that funeral home is sold or goes out of business? Your money could be gone.

- The “Hidden Cost” Risk: These plans often “lock in” the price for the funeral home’s services (like the casket and embalming), but not for the “cash advance” items. This means your family could still get a surprise bill for thousands of dollars for things like flowers, the obituary, death certificates, or the burial plot, all of which they thought were included.

- The “No Leftovers” Problem: If you pre-pay $15,000 and your family chooses a simpler $10,000 service, the funeral home often keeps the $5,000 difference. With a cash policy, that money would have gone to your family.

What Are My Other Options?

- A Savings Account: This is an option, but it’s risky. Your savings can be frozen by the bank at death (a process called probate) and can be seized by creditors for medical bills. A life insurance payout is protected from creditors and is paid to your family in days.

- Term Life Insurance: This is a very cheap option for a healthy 50- or 60-year-old, but it is temporary. It will expire, likely leaving you with no coverage at all when you need it most.

Stop Wasting Money. Get the Right Tool.

Get a free quote today and see if you’re overpaying.

Frequently Asked Questions (FAQ)

The best age is today. The rate is based on your age when you apply, and it is then locked in forever. The rate you get at 65 is much cheaper than the one you’ll be offered at 70.

Always apply for Simplified Issue first. It’s cheaper. The application is smart and will automatically “find your fit.” If your health “knocks you out” of the simplified plan, you will then be offered the Guaranteed Issue plan. You don’t have to guess.

This is the best part of a cash policy. If you have a $15,000 policy and the funeral costs $10,000, your beneficiary keeps the extra $5,000, tax-free. It’s a final gift they can use to pay a bill, take time off work, or simply have as a cushion.

Yes. While they accept many common conditions, these policies will typically “knock you out” for very serious, recent events, like a current cancer diagnosis, being in a nursing home, or having had a heart attack in the last 1-2 years. If you are declined, you can (and should) immediately apply for a “Guaranteed Issue” plan.

This is a common worry. Your beneficiary can still file a claim with just your name and Social Security Number. You can also use the free policy locator service from the National Association o